Propane

Companies Now Have a Robust Toolkit for Hedging Propane Price Risk

Propane fundamentals have shifted dramatically in the U.S. in less than a decade. Growth in oil and natural gas processing from shale contributed to a wave of export capacity investment in the U.S. Gulf Coast region which allowed the U.S. to become a net propane exporter and a leading supplier to the global marketplace.

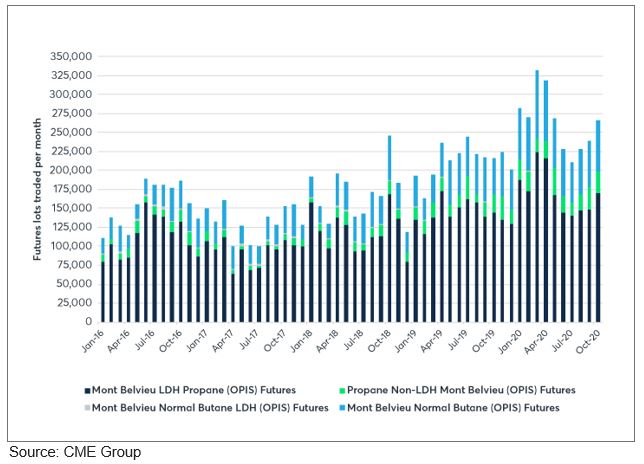

A dramatic growth in the adoption of financially-settled propane futures and options now offers marketers a liquid market to hedge their price risk.

Qualified marketers can also access over-the-counter propane swaps to create customized risk-management tools.

POWERHOUSE helps commercial and retail propane marketers increase their margins and market more effectively.

Commercial Propane Marketers

If you sell propane to agricultural or commercial customers, you know how important every penny can be. At POWERHOUSE, we show our clients how they can save more than five cents a gallon when locking in fixed price deals with customers.

Contact us now and let POWERHOUSE show you how to add these savings back to your bottom line.

Retail Propane Marketers

Retail propane marketers have long faced the challenge of aggregating enough customer volume in order to hedge effectively.

Qualifying marketers can now offer their customers price protection programs in any gallon size. With the POWERHOUSE CustomQuotes platform, marketers can hedge 1,000 gallons of propane over a season as easily as 500,000 gallons.

Contact us to arrange a demonstration of this dynamic new platform.