Petroleum demand in China slowing Aging workforce a barrier to growth China’s exports of petroleum products on the rise Drought slowing traffic through the Panama canal The Matrix The ascendance of China has been the demand story of this century so far. In 2000,...

Our Latest Resources

Worldwide Demand for Oil Continues to Grow

Global oil demand hits new highwater mark

Refinery margins expand as inventories fall

Upcoming PADD 1 refinery maintenance supportive of price

Possible labor strikes threaten global LNG output

Saudi Arabia Extends Support For Petroleum Prices

Record crude stock draw mostly due to adjustment

Saudi Arabia extends production cuts into September

Global distillate stocks are running below average

Natural gas prices remain rangebound

Oil Price Setback Not Tied to Petroleum Fundamentals

– ULSD price falls after $0.43 rally

– Decline not tied to supply/demand fundamentals

– Analysts raise crude oil price forecast to $100

– Natural gas consumption falls

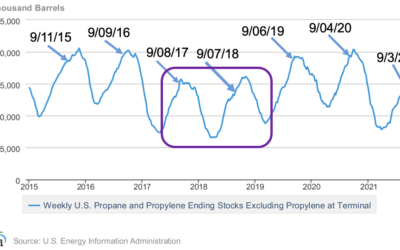

Propane Market Update

Highlights

1) Lowest pre-winter U.S. propane inventories in the last seven years

2) Arbitrage window currently incentivizes U.S. producers to export

3) Strong price rally nearing a decision point

Impact of H. Ida Shown for the First Time – WEMS – 9.13.21

Highlights

1. Refinery use falls on Gulf Coast

2. Gasoline demand rises

3. Domestic crude oil production loses 1.5 million barrels daily

4. Natural gas price holds $5.00

Oil Futures Prices Rangebound Despite Cat 4 Hurricane – WEMS – 9.7.21

Highlights

1. Latest EIA data bullish

2. Covid-19 restrains prices

3. Mu variant now appearing

4. Natural gas prices approach major resistance

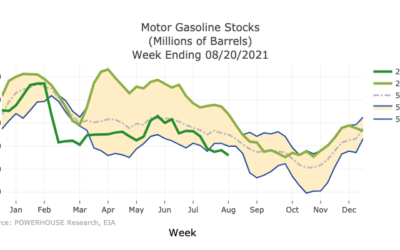

Markets Respond Slowly to Hurricane Ida and Afghan Withdrawal – WEMS – 8.30.21

Highlights

1. Uncertainty shrouds U.S. withdrawal from Afghanistan

2. U.S. gasoline inventories below five-year average

3. Natural gas injections well below expectations

Weekly Energy Market Situation 7.12.21

1. 44 million Americans hit the road for the July 4th Holiday Weekend

2. U.S. gasoline demand tops 10 million barrels per day for the first time

3. Crude domestic production slowly moving higher, makes a post-pandemic high

4. Extreme heat in the West adding support to natural gas prices

Weekly Energy Market Situation 7.6.21

1. New oil targets around $100 per barrel

2. Refinery inputs rise

3. Higher prices could invite political response

4. LNG exports are flat in 2020