Highlights

- Uncertainty shrouds U.S. withdrawal from Afghanistan

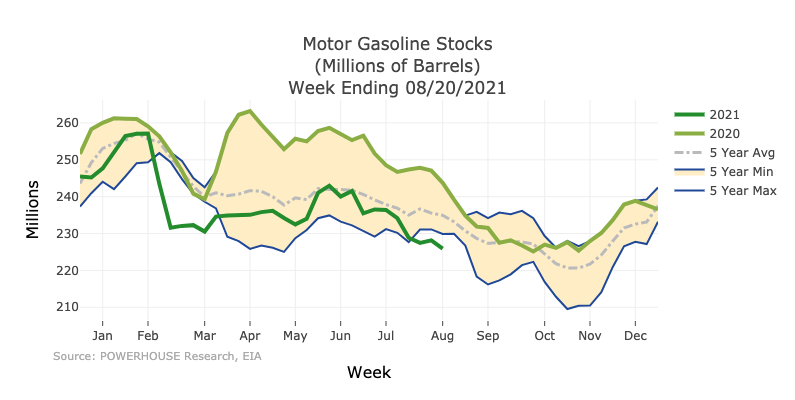

- U.S. gasoline inventories below five-year average

- Natural gas injections well below expectations

The Matrix

The regional balance of power could be affected when the United States departs Afghanistan. While the US retains the ability to project military power ‘over-the-horizon’, the withdrawal of on the ground forces in the region may open the door to uncertainty in larger strategic political relationships including those among the oil-rich nations in the region.

Oil demand in the U.S. remains a focus of the markets. The most recent report from the EIA showed gasoline demand rising to 9.57 million barrels per day with gasoline sales expected to be even stronger during the upcoming Labor Day holiday weekend. Gasoline inventories have now fallen below the five-year average for this time of year.