Propane Pricing: Where Are We Now?

- Mont Belvieu (and Conway) propane futures prices have been in a massive rally phase since mid-April.

- The cause of this rally has been simple fundamentals – strong domestic demand and strong exports have led to exceptionally low domestic inventory levels ahead of the upcoming high demand period.

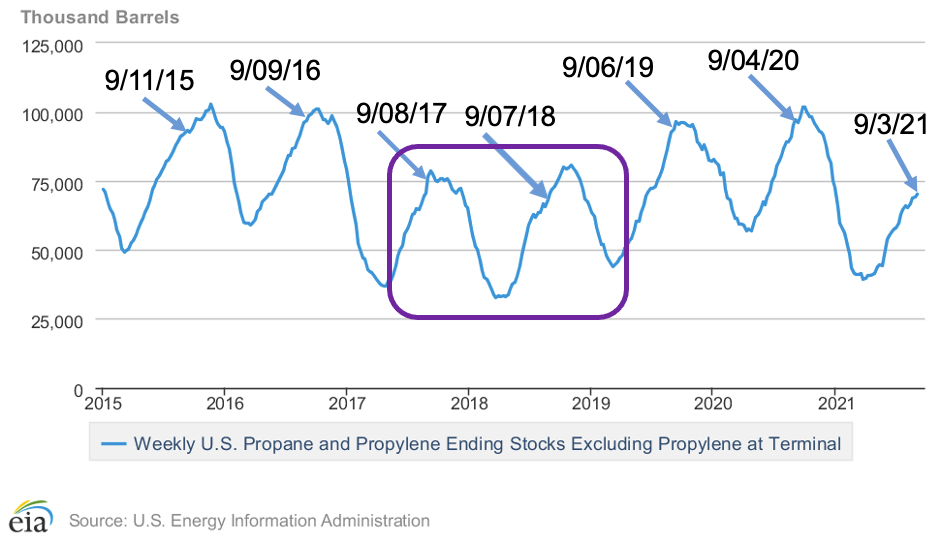

- The following chart shows the last seven years of U.S. propane inventory history. 2017 & 2018 are highlighted because they were years in which pre-winter inventories were below average – although it’s critical to note that this year inventory levels are even lower than those two years.

End of Propane Storage Building Season Nears

Propane Arbitrage to Asia

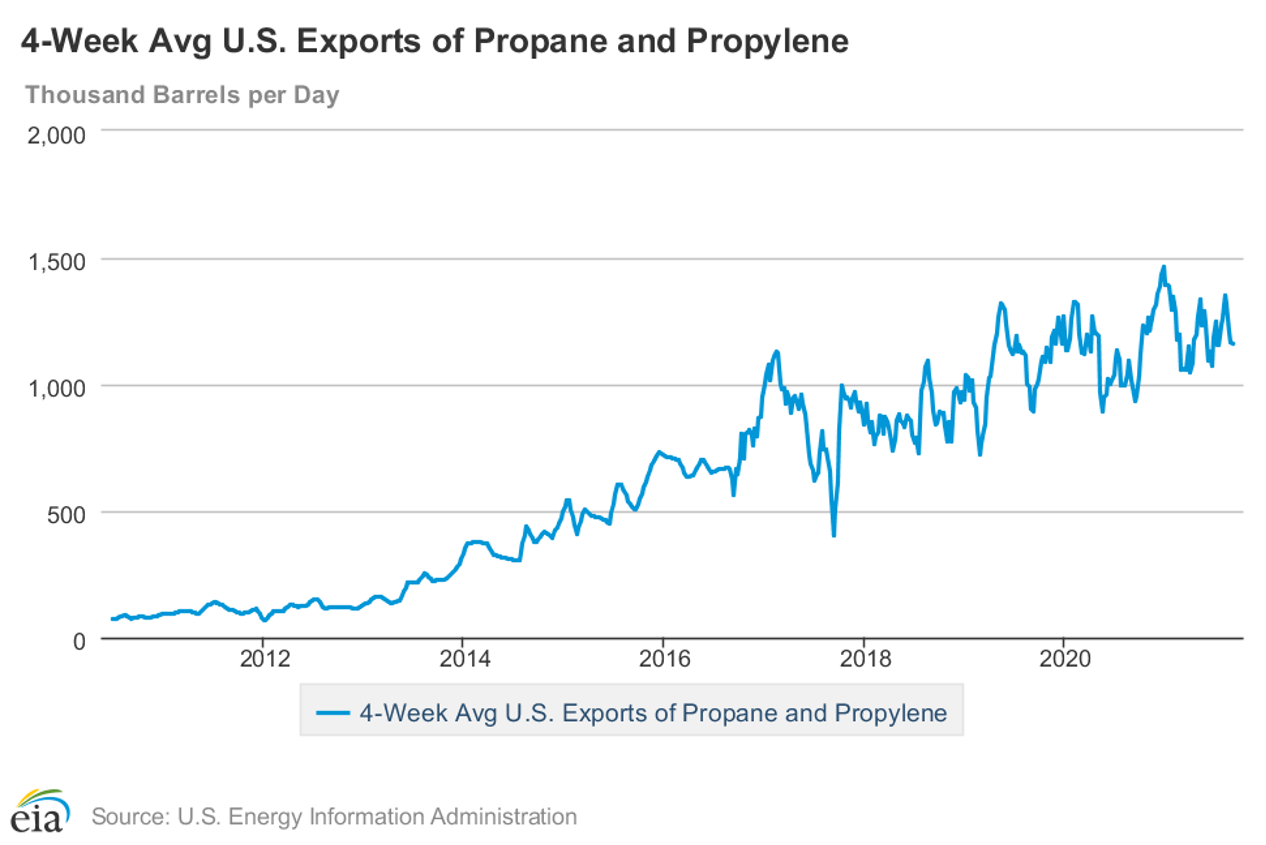

- The arbitrage window to incentivize U.S. producers to ship propane to Asia is open.

- The price difference between November ’21 as well as January ’22 OPIS Mont Belvieu futures and the corresponding Argus Propane Far East Index futures is currently over 21 cents per gallon.

- These price differentials are more than enough to cover the cost of shipping to Asia.

- U.S. Gulf Coast propane export capacity has increased significantly over the last five years.

Propane Exports Continue Upward

Low, Pre-Winter Propane Inventory Analogs

Bearish Market Factors for Propane

- Warmer than expected North American and North Asian winter temperatures.

- Less U.S. crop drying demand.

- Significant ramp up in U.S. shale production with accompanying LPG production.

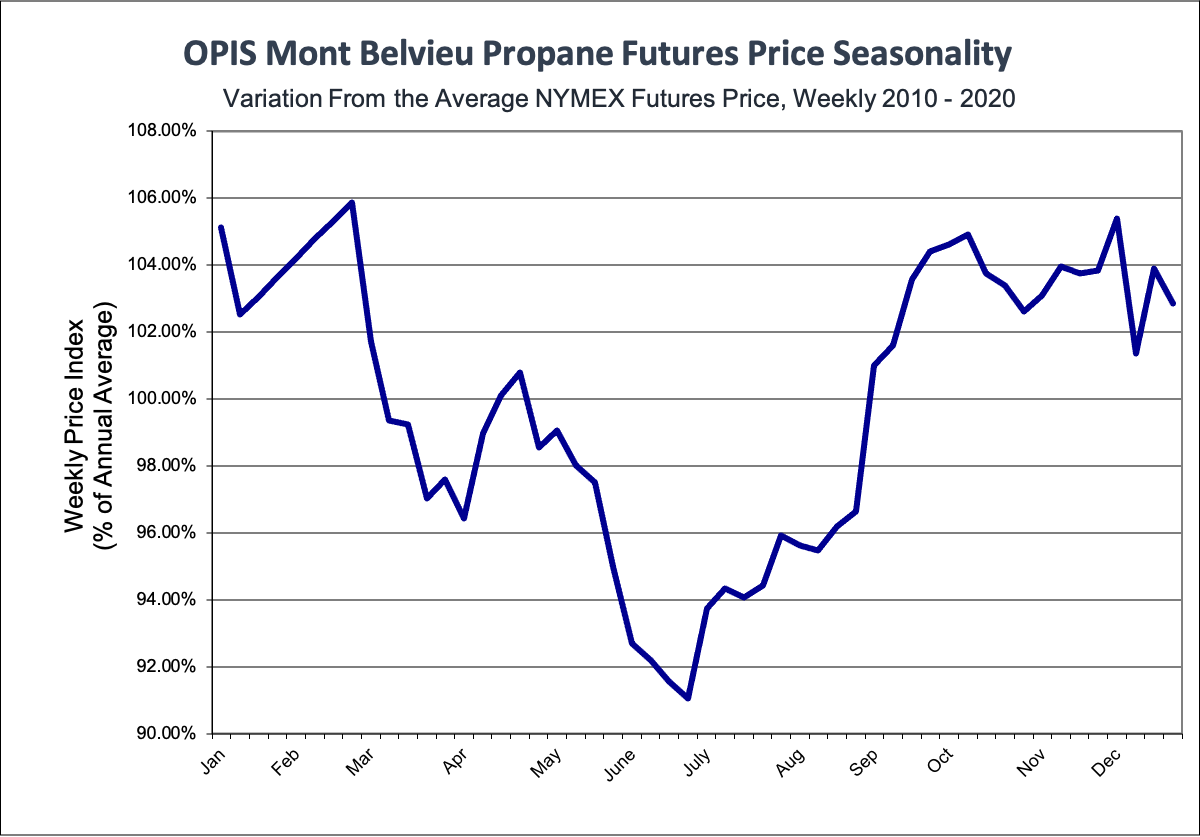

- The seasonal price pattern tends to top between mid-October and mid-November.

Conclusions

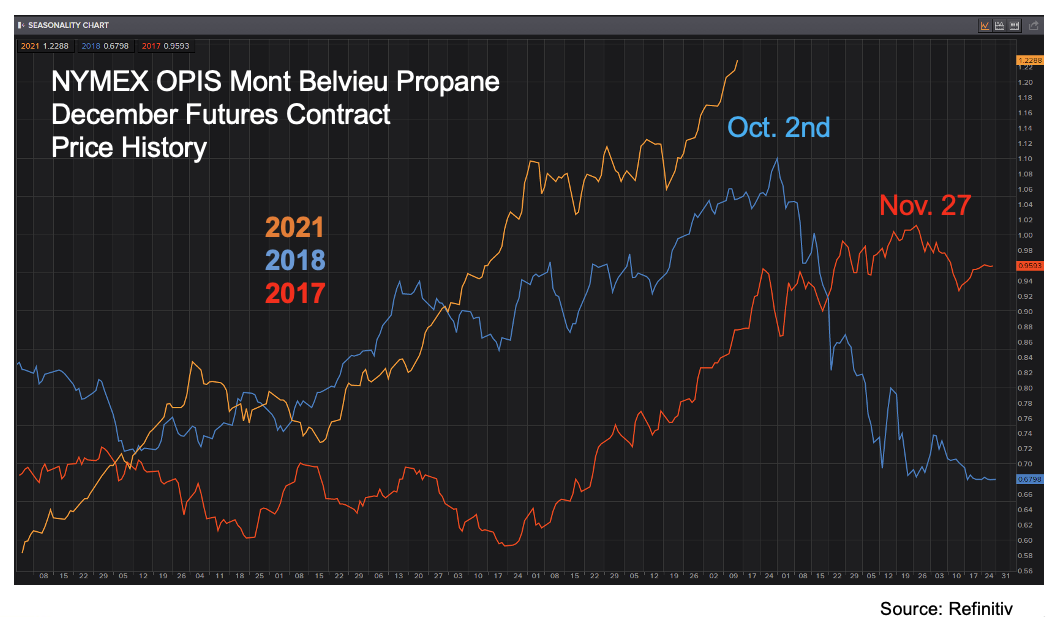

- Pre-winter propane inventories have been significantly below average in two out of the previous six years. In both of those years, 2017 & 2018, Mont Belvieu propane futures prices rallied sharply between April and October/November.

- Heading into winter 2021-22, U.S. propane inventories are even lower than the 2017 or 2018 levels.

- Using the December 2021 Mont Belvieu futures contract as a proxy for winter, we see the same pattern has developed – a massive price rally starting in April.

- The question facing market participants is whether the current market follows the path of 2018 and the rally comes to an end in October or do the extraordinarily low domestic inventories levels propel the price rally into November.

- My current view is that while the arbitrage window to Asia remains open, bullish price behavior will continue to dominate.