by Matt Walker | Sep 17, 2021 | Featured, Hedging Insights and Analysis

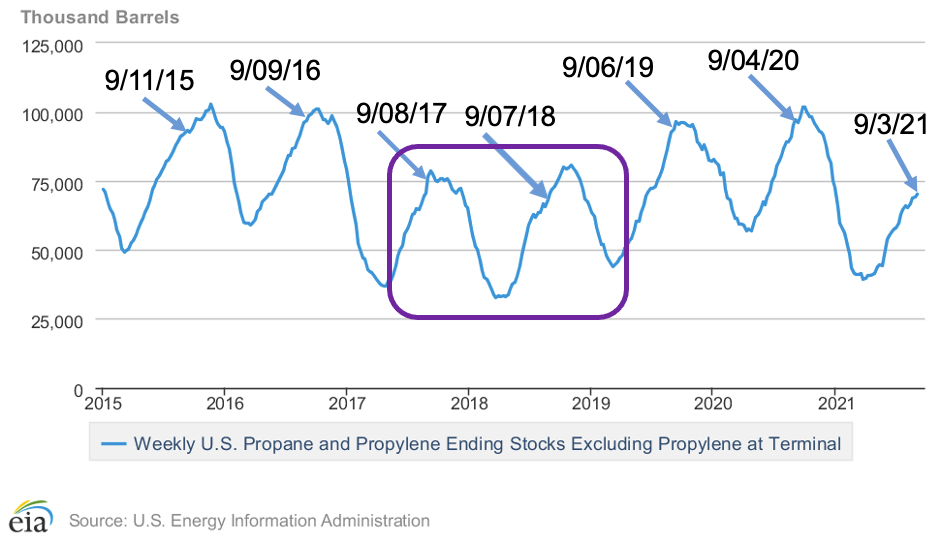

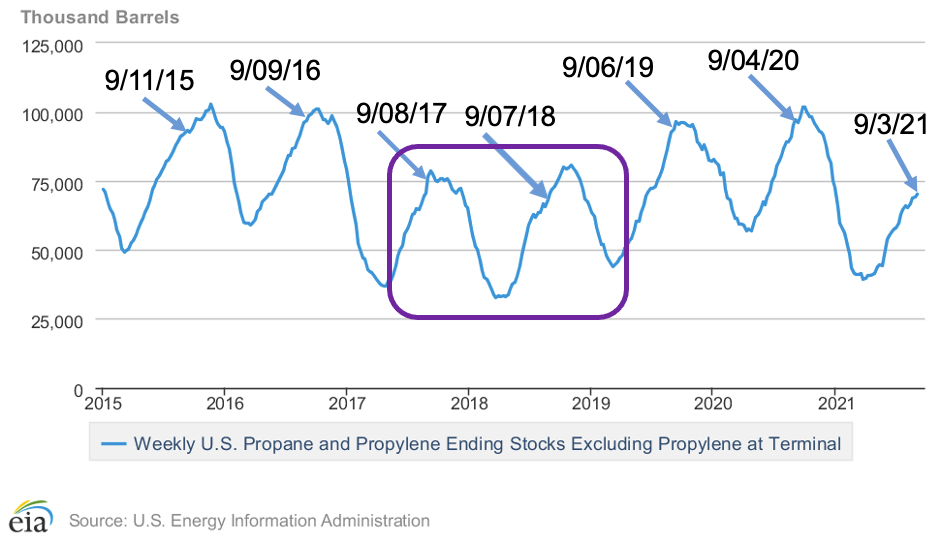

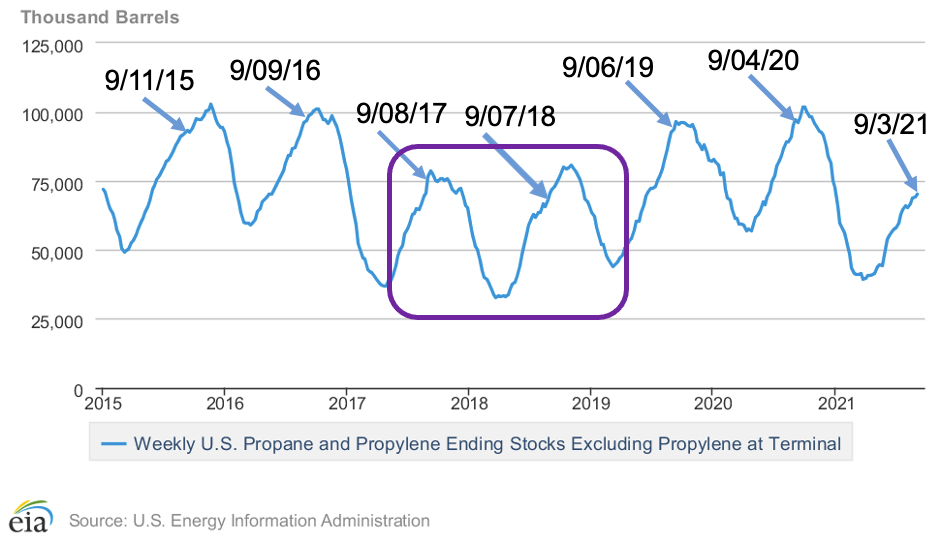

Propane Pricing: Where Are We Now? Mont Belvieu (and Conway) propane futures prices have been in a massive rally phase since mid-April. The cause of this rally has been simple fundamentals – strong domestic demand and strong exports have led to exceptionally low... read more

by Matt Walker | Sep 13, 2021 | Featured, Hedging Insights and Analysis

Highlights Refinery use falls on Gulf Coast Gasoline demand rises Domestic crude oil production loses 1.5 million barrels daily Natural gas price holds $5.00 The Matrix Government data on the impact of H. Ida on energy interests made their appearance in the... read more

by Matt Walker | Sep 7, 2021 | Featured, Hedging Insights and Analysis

Highlights Latest EIA data bullish Covid-19 restrains prices Mu variant now appearing Natural gas prices approach major resistance The Matrix The weekly Energy Information Administration supply & demand report for the week ending August 27 did not reflect the... read more

by Matt Walker | Aug 30, 2021 | Featured, Hedging Insights and Analysis

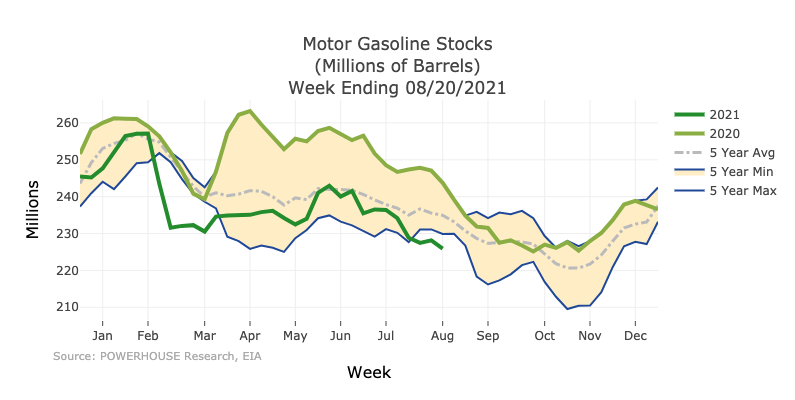

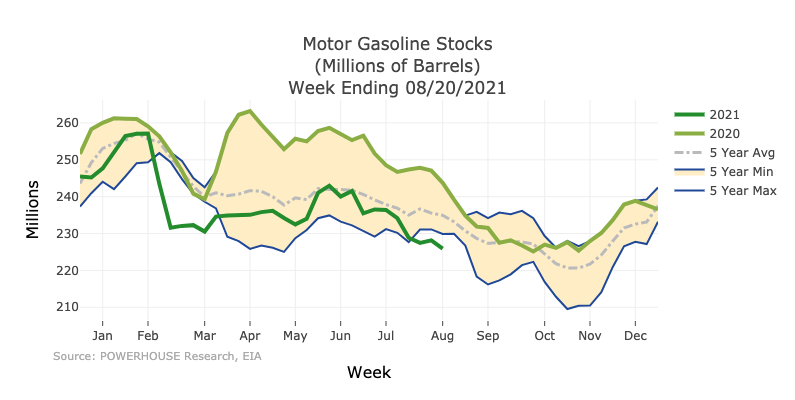

Highlights Uncertainty shrouds U.S. withdrawal from Afghanistan U.S. gasoline inventories below five-year average Natural gas injections well below expectations The Matrix Powerhouse has chronicled an oil market trading in a price range through the summer now drawing... read more

by Matt Walker | Aug 8, 2018 | Featured, Videos and Podcasts

OPIS Crash Course Podcast Elaine Levin Listen to Elaine and Jessica talk about "How Hedging Can Help Protect Against Diesel Price Swings". ... Listen to the full episode... read more