- Global oil demand hits new highwater mark

- Refinery margins expand as inventories fall

- Upcoming PADD 1 refinery maintenance supportive of price

- Possible labor strikes threaten global LNG output

The Matrix

Global demand growth for oil appeared challenging as 2023 started. Would the U.S. economy fall into recession? How fast could demand in China rebound from Covid lockdowns? Would renewable energy growth displace petroleum use? Will last year’s high prices be the cure for future high prices? These concerns about slowing usage have not materialized. Just over the halfway point of the year, world demand for petroleum is on track for a new record.

The world consumed a record 103 million barrels per day (mb/d) this June, and demand could rise even more this month. According to a recent report from the Paris-based International Energy Agency (IEA), “Oil demand is scaling record highs, boosted by strong summer air travel, increased oil use in power generation and surging Chinese petrochemical activity,” Looking at 2023 as a whole, the agency expects global oil demand will expand by 2.2 million barrels per day (mb/d) to a record 102.2 mb/d.

Surging demand continues to take a toll on inventories. Global stocks of crude oil and petroleum products have drawn sharply. With extended cuts from Saudi Arabia and reduced output from Russia, the IEA predicts “balances are set to tighten further into the autumn.” Refining margins around the world are arising, reflecting the need for more supply of distillate and gasoline. While refining capacity has recently expanded, it is not keeping pace with current demand.

Domestic crack spreads for ULSD recently hit $50.00 a barrel, a gross refining margin not seen since winter. Gasoline margins are also strong. RBOB crack spreads are trading around $40.00. Fall turnaround is right around the corner, which will reduce refinery output. PADD 1 distillate and gasoline stocks are well below the 5-year average. Planned turnarounds at Irving’s St. John and Monroe Energy’s Trainer refineries, both important to East Coast supply, have the potential to support prices on the NYMEX.

Looking forward, there are still challenges to the strength of the world economy. The impact of rising interest rates tends to lag and China’s property market is struggling. But low petroleum inventories give little comfort.

Supply/Demand Balances

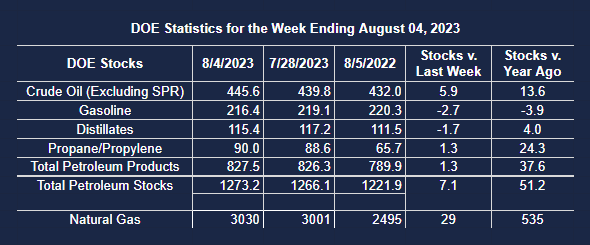

Supply/demand data in the United States for the week ending August 4, 2023 were released by the Energy Information Administration.

Total commercial stocks of petroleum rose (⬆) 7.1 million barrels to 1.2732 billion barrels during the week ending August 4, 2023.

Commercial crude oil supplies in the United States were higher (⬆) by 5.9 million barrels from the previous report week to 445.6 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Up (⬆) 0.7 million barrelsto 8.5 million barrels

PADD 2: Down (⬇) 0.4 million barrels to 119.0 million barrels

PADD 3: Up (⬆) 5.1 million barrels to 248.5 million barrels

PADD 4: Up (⬆) 0.1 million barrels at 24.3 million barrels

PADD 5: Up (⬆) 0.4 million barrels to 45.4 million barrels

Cushing, Oklahoma inventories were up (⬆) 0.1 million barrels from the previous report week to 34.6 million barrels.

Domestic crude oil production was up (⬆) 400,000 barrels at 12.6 million barrels daily.

Crude oil imports averaged 6.682 million barrels per day, a daily increase (⬆) of 14,000 barrels. Exports decreased (⬇) 2.923 million barrels daily to 2.360 million barrels per day.

Refineries used 93.8 percent of capacity; 1.1 percentage points higher (⬆) than the previous report week.

Crude oil inputs to refineries increased (⬆) 62,000 barrels daily; there were 16.579 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks,increased (⬆) 208,000 barrels daily to 17.138 million barrels daily.

Total petroleum product inventories increased (⬆) by 1.3 million barrels from the previous report week, up to 827.6 million barrels.

Total product demand increased (⬆) 704,000 barrels daily to 20.727 million barrels per day.

Gasoline stocks decreased (⬇) 2.7 million barrels from the previous report week; total stocks are 216.4 million barrels.

Demand for gasoline increased (⬆) 464,000 barrels per day to 9.302 million barrels per day.

Distillate fuel oil stocks decreased (⬇) 1.7 million barrels from the previous report week; distillate stocks are at 115.4 million barrels. EIA reported national distillate demand at 3.762 million barrels per day during the report week, a decrease (⬇) of 64,000 barrels daily.

Propane stocks increased (⬆) by 1.3 million barrels from the previous report week to 89.8 million barrels. The report estimated current demand at 803,000 barrels per day, a decrease (⬇) of 81,000 barrels daily from the previous report week.

Natural Gas

Natural gas prices briefly touched $3.00 per MMBtu on news of a new potential supply threat to global natural gas trade. Workers threaten to strike at two Australian LNG plants owned by Chevron and Woodside Energy. The facilities account for 10% of the world’s LNG supplies. Asian buyers would be the first to be impacted by a worker’s strike, but natural gas is now a global commodity. Gas prices in Europe responded strongly to the news. If negotiations break down and workers strike, the world will again look to the U.S. for alternative supply.

From the EIA:

Working gas in storage was 3,030 Bcf as of Friday, August 4, 2023, according to EIA estimates. This represents a net increase of 29 Bcf from the previous week. Stocks were 535 Bcf higher than last year at this time and 305 Bcf above the five-year average of 2,725 Bcf. At 3,030 Bcf, total working gas is within the five-year historical range.