- EIA delays the release of inventory and storage data until next week

- U.S. propane inventories above the 5-year range

- Drought slowing ships transporting energy through the Panama Canal

- Global natural gas inventories full ahead of winter

The Matrix

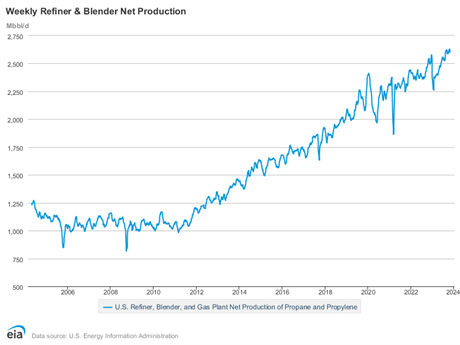

A warm winter last year moved propane stocks from a deficit to a surplus. Inventories have been running above the 5-year range since last April as production continues to grow. Grain drying demand did not move the needle. The bright spot for demand has been exports. Propane and propylene exports hit a record of 2 million barrels per day in October. However, propane exports are becoming more expensive due to a drought impacting the Panama Canal.

Propane is produced as a by-product of natural gas processing and crude oil refining. A by-product of the war in Ukraine has been increased demand for LNG and diesel. Natural gas production in the U.S. is setting records as Europe looks to us for LNG supply. U.S. refining capacity is expanding, mainly along the Gulf of Mexico. Crack spreads have been strong this year, encouraging high refinery runs. As a result, the U.S. is producing a record amount of propane.

The Panama Canal is an important transit point for energy moving to Asia from the Gulf Coast. One-third of the vessels passing through the canal carry petroleum products, hydrocarbon gas liquids, and chemicals, with chemicals tankers moving the most significant volume. East Asia has been demanding more propane as a chemical feedstock.

According to the Panama Canal Authority, an “unprecedented drought” has lowered the water levels in the lake that supplies the water needed to operate the locks. Traffic was first reduced in January to conserve water. By July, only 32 vessels per day were allowed to pass. On November 7th, the number will be further reduced to 24 ships per day. The restrictions have resulted in significant wait times to access the canal and higher shipping costs. Of course, product can move East via the Suez Canal, but that increases the transit time and the cost.

It is not uncommon to see propane prices fall from now through the end of the year. A strong export market will be needed reduce inventories and support price. Beyond that, it is up to Mother Nature. A colder-than-normal winter would go a long way to work through the current surplus. The jury is out if the current El Nino will be strong enough to give us a repeat of last year’s warm temperatures. If you are concerned about the potential for a continued decline in propane prices, you could buy puts. The put buyer is protected if prices fall but can still benefit from an increase in price. Contact POWERHOUSE for more information.

Supply/Demand Balances

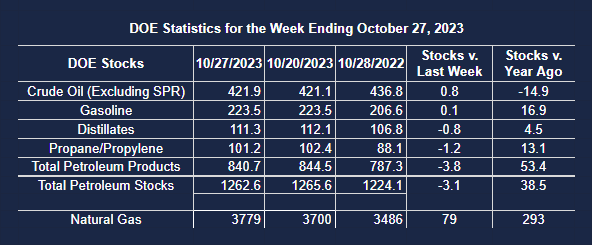

Supply/demand data in the United States for the week ending October 27, 2023 were released by the Energy Information Administration.

Total commercial stocks of petroleum fell (⬇) 3.1 million barrels to 1.2626 billion barrels during the week ending October 27, 2023.

Commercial crude oil supplies in the United States were higher (⬆) by 0.8 million barrels from the previous report week to 421.9 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Up (⬆) 0.3 million barrels to 7.9 million barrels

PADD 2: Up (⬆) 1.1 million barrels to 103.7 million barrels

PADD 3: Down (⬇) 0.7 million barrels to 241.8 million barrels

PADD 4: Up (⬆) 0.1 million barrels to 23.5 million barrels

PADD 5: Up (⬆) 0.1 million barrels to 45.0 million barrels

Cushing, Oklahoma inventories were up (⬆) 0.3 million barrels from the previous report week to 21.5 million barrels.

Domestic crude oil production was unchanged (=) at 13.2 million barrels daily.

Crude oil imports averaged 6.425 million barrels per day, a daily increase (⬆) of 412,000 barrels. Exports increased (⬆) 64,000 barrels daily to 4.897 million barrels per day.

Refineries used 85.4 percent of capacity; 0.2 percentage points lower (⬇) than the previous report week.

Crude oil inputs to refineries increased (⬆) 62,000 barrels daily; there were 15.251 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, decreased (⬇) 27,000 barrels daily to 15.607 million barrels daily.

Total petroleum product inventories decreased (⬇) by 3.8 million barrels from the previous report week, down to 840.7 million barrels.

Total product demand decreased (⬇) 233,000 million barrels daily to 19.869 million barrels per day.

Gasoline stocks increased (⬆) 0.1 million barrels from the previous report week; total stocks are 223.5 million barrels.

Demand for gasoline decreased (⬇) 167,000 barrels per day to 8.697 million barrels per day.

Distillate fuel oil stocks decreased (⬇) 0.8 million barrels from the previous report week; distillate stocks are at 111.3 million barrels. EIA reported national distillate demand at 3.682 million barrels per day during the report week, a decrease (⬇) of 387,000 barrels daily.

Propane stocks decreased (⬇) by 1.2 million barrels from the previous report week to 101.2 million barrels. The report estimated current demand at 937,000 barrels per day, an increase (⬆) of 112,000 barrels daily from the previous report week.

Natural Gas

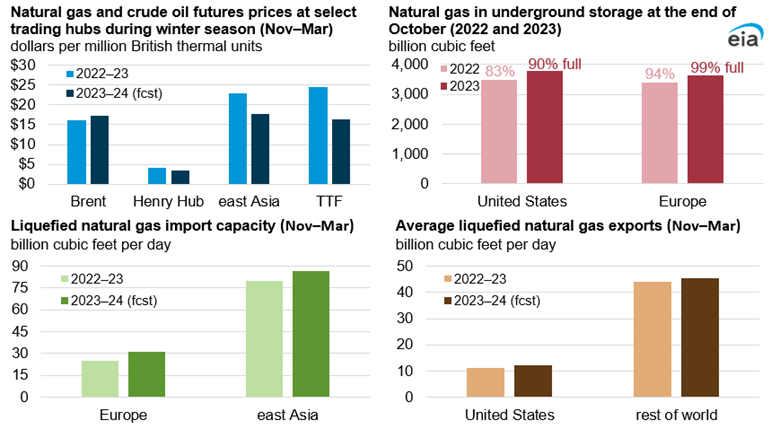

The EIA released their Global LNG Winter Outlook for 2023-2024. The supply picture for the upcoming winter is much improved over last year. Inventories in both the U.S. and Europe are relativity full. Expanded capacity to both export and import liquified natural gas “improve the likelihood that supply will be sufficient to meet demand in global natural gas markets” as we enter the upcoming winter.

Source: EIA

There are still potential challenges for the global market. LNG consumption in Asia is a wildcard. Extended cold weather in the Northern Hemisphere or unplanned supply outages could change the global balance and spike the price of supply. “Other supply disruptions could occur, such as a further reduction in pipeline exports from Russia transiting Ukraine, worker strikes at Australian LNG facilities, spread of the military conflict in the Middle East, or other potential unplanned outages affecting global supplies.”

From the EIA Weekly Storage Report:

- Working gas in storage was 3,779 Bcf as of Friday, October 27, 2023, according to EIA estimates. This represents a net increase of 79 Bcf from the previous week. Stocks were 293 Bcf higher than last year at this time and 205 Bcf above the five-year average of 3,574 Bcf. At 3,779 Bcf, total working gas is within the five-year historical range.