- Gasoline futures curves are shifting

- Low distillate stocks supporting ULSD crack spreads

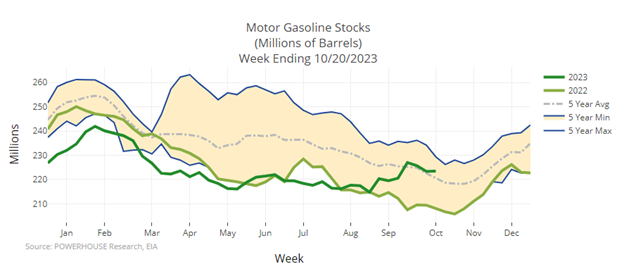

- Gasoline inventories above the 5-year average

- Natural gas storage injection below expectations again this week

The Matrix

In 2008, China hosted the Summer Olympics in Beijing. In preparation for hosting the world, the Chinese government went on an infrastructure spending spree. Roads were built. The electric grid was expanded. New airports were constructed. The Chinese economy was roaring. So was demand for industrial commodities. It was estimated that China alone was pouring over half of the world’s concrete. All this growth required energy, particularly diesel. A refinery can only make diesel by also making gasoline. A global diesel shortage in 2008 led to a surplus supply of gasoline. Is something similar happening now?

Gasoline inventories are now above the 5-year average. Gasoline demand has struggled to return to pre-pandemic levels. Remote work, EV adoption, and, most importantly, improving fuel economy have impacted demand. And as the weather gets colder, we tend to drive less.

It is a very different story for distillate inventories. Since the invasion of Ukraine by Russia, global stocks have been running well below average. Despite a mild winter in the U.S. and Europe, supply struggled to rebuild. Fall refinery turnarounds have tightened the situation further.

Just like in 2008, the world needs more distillate. And just like in 2008, a refiner’s margin for making diesel is running around four times higher than for gasoline. The December ULSD crack is trading closer to $40.00 per barrel. A refiner only sees around $10.00 a barrel for producing winter-grade RBOB. As the autumn refinery maintenance season draws to a close, refiners are incentivized to increase runs to make more distillates, which could lead to further builds in gasoline inventories.

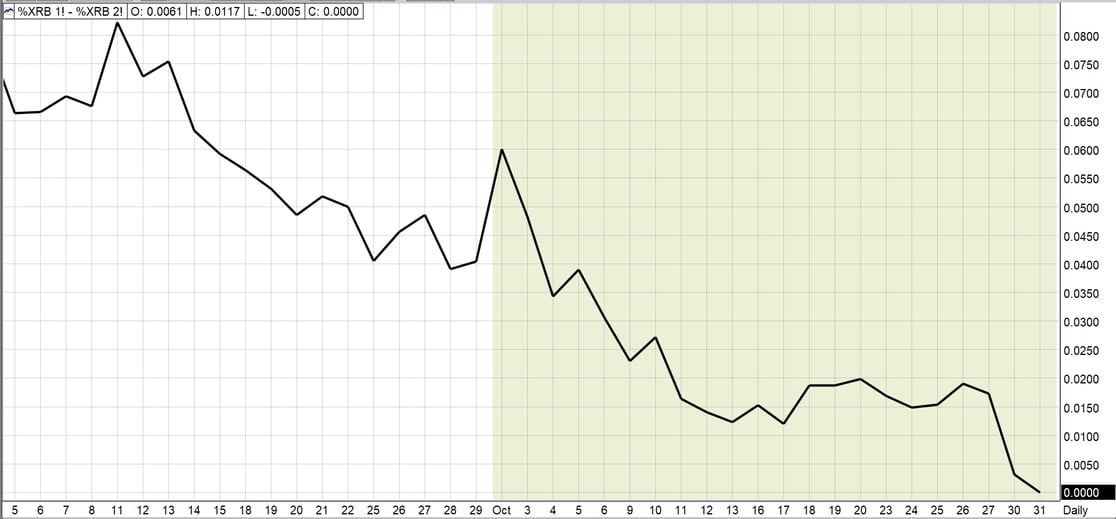

The shape of the futures curve changes in response to the availability of supply. Below is a rolling continuation chart of the 1st minus 2nd nearby RBOB futures.

Source: FutureSource

U.S. gasoline inventories started to move above the low of the 5-year range in early September. At the time, the 1st vs. 2nd month futures spread (October minus November) was backwardated by around 7 cents, indicating tight supply. At writing, the 1st vs 2nd (December-January) RBOB spread is approaching flat. Looking out the curve, January- February spread is in a small carry. So is April-May of next year.

Ultimately, if the carry is wide enough to cover the cost of money and the cost of storage, it will encourage those who have storage to fill it, supporting further inventory builds. A carry market is good news for anyone who stores or ships product. It has been over a year since we have seen carry in the first two months of RBOB, grade change aside.

Supply/Demand Balances

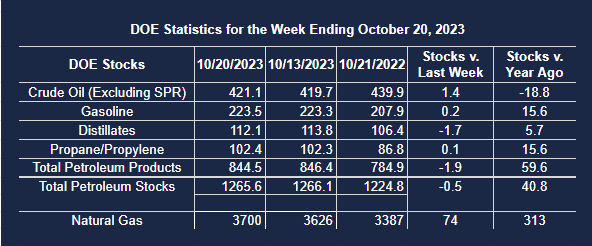

Supply/demand data in the United States for the week ending October 20, 2023 were released by the Energy Information Administration.

Total commercial stocks of petroleum fell (⬇) 0.5 million barrels to 1.2656 billion barrels during the week ending October 20, 2023.

Commercial crude oil supplies in the United States were higher (⬆) by 1.4 million barrels from the previous report week to 421.1 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Unchanged (=) at 7.6 million barrels

PADD 2: Up (⬆) 0.7 million barrels to 102.6 million barrels

PADD 3: Down (⬇) 0.3 million barrels to 242.5 million barrels

PADD 4: Up (⬆) 0.1 million barrels to 23.4 million barrels

PADD 5: Up (⬆) 0.6 million barrels to 44.9 million barrels

Cushing, Oklahoma inventories were up (⬆) 0.2 million barrels from the previous report week to 21.2 million barrels.

Domestic crude oil production was unchanged (=) at 13.2 million barrels daily.

Crude oil imports averaged 6.013 million barrels per day, a daily increase (⬆) of 71,000 barrels. Exports decreased (⬇) 468,000 barrels daily to 4.833 million barrels per day.

Refineries used 85.6 percent of capacity; 0.5 percentage points lower (⬇) than the previous report week.

Crude oil inputs to refineries decreased (⬇) 200,000 barrels daily; there were 15.189 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, decreased (⬇) 101,000 barrels daily to 15.634 million barrels daily.

Total petroleum product inventories decreased (⬇) by 1.9 million barrels from the previous report week, down to 844.5 million barrels.

Total product demand decreased (⬇) 1.795 million barrels daily to 20.102 million barrels per day.

Gasoline stocks increased (⬆) 0.2 million barrels from the previous report week; total stocks are 223.5 million barrels.

Demand for gasoline decreased (⬇) 80,000 barrels per day to 8.864 million barrels per day.

Distillate fuel oil stocks decreased (⬇) 1.7 million barrels from the previous report week; distillate stocks are at 112.1 million barrels. EIA reported national distillate demand at 4.060 million barrels per day during the report week, a decrease (⬇) of 347,000 barrels daily.

Propane stocks increased (⬆) by 0.1 million barrels from the previous report week to 102.4 million barrels. The report estimated current demand at 826,000 barrels per day, a decrease (⬇) of 668,000 barrels daily from the previous report week.

Natural Gas

Natural gas futures for the spot month rallied last week. EIA produced a bullish storge report, and the implications of events overseas added to price strength.

After a pause at the end of the week, a new front-month contract (the December futures contract) greeted the market on Monday and the brief pause continued. However, as of press time for this report on Tuesday, a dramatic bullish engulfing pattern is evident and a new high price for the most recent move has been reached. As long as the front- month natural gas futures contract remains above $3.471, the bulls remain in control.

We are approaching the end of this year’s injection period with EIA projecting 3.8 Tcf natural gas available as of October 31st. This would be 183 Bcf more than the average of the past five years.

North American LNG has become a mainstay of international commerce. The Energy Information Administration has provided data on several new exports facilities that could be online by the end of 2027.

The agency expects export capacity to reach 12.9 Bcf/d for all of North America. This includes new facilities in Mexico and Canada. Ten new projects are on the books, three in Mexico and two in Canada. The impact of these plants could add materially to the importance of LNG in regional export balances.

According to the EIA:

- The net injections into storage totaled 74 Bcf for the week ending October 20, compared with the five-year (2018–2022) average net injections of 66 Bcf and last year’s net injections of 61 Bcf during the same week. Working natural gas stocks totaled 3,700 Bcf, which is 183 Bcf (5%) more than the five-year average and 313 Bcf (9%) more than last year at this time.

- According to The Desk survey of natural gas analysts, estimates of the weekly net change to working natural gas stocks ranged from net injections of 73 Bcf to 89 Bcf, with a median estimate of 82 Bcf.

- The average rate of injections into storage is 6% lower than the five-year average so far in the refill season (April through October). If the rate of injections into storage matched the five-year average of 7.1 Bcf/d for the remainder of the refill season, the total inventory would be 3,778 Bcf on October 31, which is 183 Bcf higher than the five-year average of 3,595 Bcf for that time of year.