- OPEC meeting delayed until November 30th

- African producers unhappy with proposed lower production levels

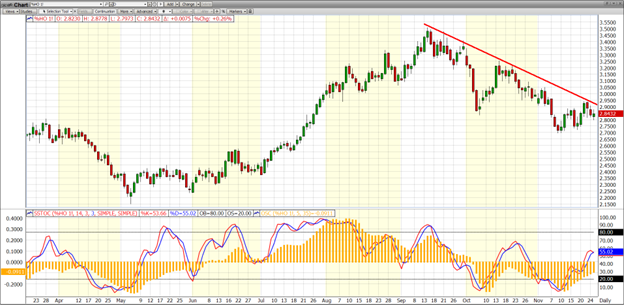

- ULSD futures moving lower with trendline

- January 2024 natural gas futures under $3.00

The Matrix

Brent crude oil prices topped out on September 28th at $97.69. Prices increased 30% from June when Saudi Arabia and Russia first announced voluntary production cuts. A unilateral 1 million barrel per day cut per day by Saudi Arabia surprised the market. The year’s high price was made shortly after the announcement that voluntary output cuts would remain in place through the end of the year. Many analysts believed the reduction in output would translate into oil prices exceeding $100 per barrel. The bullish calls have yet to materialize, and the OPEC meeting scheduled this month is instead against a backdrop of falling prices.

Running a successful cartel is not an easy business. Historically, producers of tin, steel, rubber, and coffee, to name a few, have banded together in an attempt to support prices. Any success tended to be short-lived. Members are inherently in conflict. The discipline needed to cut production is often overcome by the desire to produce more, especially at a higher price. Ultimately, high prices usher in new competition and new technologies. OPEC, now with the help of Russia (the most important “+” in OPEC+), has been more successful than most cartels. The reason is that Saudi Arabia’s outsized production gives them outsized power. And with spare production capacity estimated at 3 million barrels per day, the Kingdom could ultimately flood the market to punish producers not holding up their share of the deal.

Crude oil prices are showing signs of weakness. Demand is falling in Europe, China, and domestically as higher interest rates start to bite. The expectation was that falling prices would trigger additional cuts, above an expected extension of Saudi Arabia’s and Russia’s voluntary cuts. Not all members are on board. Nigeria and Angola have signaled that they are against lower output quotas. OPEC delayed the start of the meeting as the negotiations continued. Even though the group will ultimately come to a consensus, the discord does not bode well for all members’ adherence to any new cut.

Crude oil demand should see a seasonal boost as refineries return to full-service post-fall maintenance. Additional refining is desperately needed to increase distillate stocks in front of winter. The EIA reported that distillate stocks fell by 1 million barrels last week, bringing inventories to 105 million. Declining crude oil prices and weaker global demand have allowed diesel futures to fall. Prices are following a downtrend line lower since September. Trendline resistance would be breached with a close above 2.90.

Supple/Demand Balances

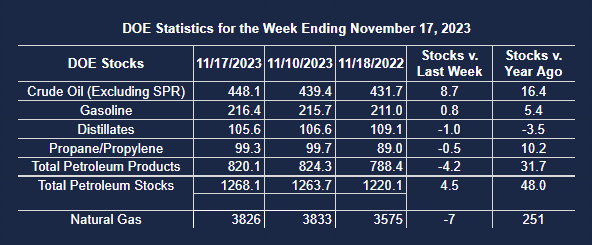

Supply/demand data in the United States for the week ending November 17, 2023 were released by the Energy Information Administration.

Total commercial stocks of petroleum rose (⬆) 4.5 million barrels to 1.2681 billion barrels during the week ending November 17, 2023.

Commercial crude oil supplies in the United States were higher (⬆) by 8.7 million barrels from the previous report week to 448.1 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Down (⬇) 1.1 million barrels to 8.4 million barrels

PADD 2: Up (⬆) 1.1 million barrels to 109.2 million barrels

PADD 3: Up (⬆) 5.5 million barrels to 257.9 million barrels

PADD 4: Up (⬆) 1.3 million barrels to 24.2 million barrels

PADD 5: Up (⬆) 1.8 million barrels to 48.3 million barrels

Cushing, Oklahoma inventories were up (⬆) 0.9 million barrels from the previous report week to 25.9 million barrels.

Domestic crude oil production was unchanged (=) at 13.2 million barrels daily.

Crude oil imports averaged 6.529 million barrels per day, a daily increase (⬆) of 156,000 barrels. Exports decreased (⬇) 103,000 barrels daily to 4.786 million barrels per day.

Refineries used 87.0 percent of capacity; 0.9 percentage points higher (⬆) than the previous report week.

Crude oil inputs to refineries increased (⬆) 105,000 barrels daily; there were 15.504 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, increased (⬆) 161,000 barrels daily to 15.901 million barrels daily.

Total petroleum product inventories decreased (⬇) by 4.3 million barrels from the previous report week, up to 820.0 million barrels.

Total product demand decreased (⬇) 38,000 barrels daily to 20.042 million barrels per day.

Gasoline stocks increased (⬆) 0.7 million barrels from the previous report week; total stocks are 216.4 million barrels.

Demand for gasoline decreased (⬇) 469,000 barrels per day to 8.480 million barrels per day.

Distillate fuel oil stocks decreased (⬇) 1.0 million barrels from the previous report week; distillate stocks are at 105.6 million barrels. EIA reported national distillate demand at 4.110 million barrels per day during the report week, an increase (⬆) of 1,000 barrels daily.

Propane stocks decreased (⬇) by 0.5 million barrels from the previous report week to 99.3 million barrels. The report estimated current demand at 982,000 barrels per day, an increase (⬆) of 128,000 barrels daily from the previous report week.

Natural Gas

A rally in natural gas futures prices fizzled on the last trading day of October at $3.63. Prices have since fallen back under $2.80 per MMBtu. January 2024 NG futures traded under $3.00 for the first time in 2023. Ample storage in Europe and at home, combined with high production levels, has pressured prices as the industry begins the withdrawal season.

According to the EIA:

- Working gas in storage was 3,826 Bcf as of Friday, November 17, 2023, according to EIA estimates. This represents a net decrease of 7 Bcf from the previous week. Stocks were 251 Bcf higher than last year at this time and 249 Bcf above the five-year average of 3,577 Bcf. At 3,826 Bcf, total working gas is within the five-year historical range.