- Oil futures traded in a tight weekly range

- U.S. crude oil exports are growing

- Dominance of OPEC+ challenged

- The natural gas situation remains bearish

The Matrix

Futures for spot crude oil and petroleum products traced out a low-volatility range last week. Brent crude oil, the marker for global crude oil prices, reportedly had its narrowest price range since 2021.

WTI, the American crude oil price standard, traded an inside range for the week. Technically, this rendered its value for trading decisions moot. We are left to ponder the direction and intensity of market action in the weeks ahead.

The situation was similar for distillate fuel oil and gasoline. Both contracts traded “inside” weeks. Last week’s high was lower than the prior week and the week’s low was higher than the low of the previous week. This week has opened bearishly. Distillate fuel oil is threatening the low of $2.5912 on March 6 on a continuous chart. A break of that level opens the way to $2.5075 seen on January 3.

The market situation around mid-March is not unusual. Winter is slipping away and, with it, demand for distillate fuel oils and propane. It is a bit early to see a significant rebound in gasoline use.

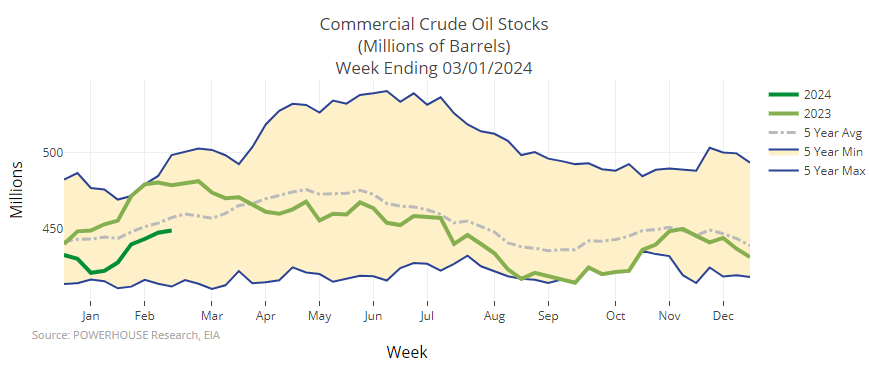

Commercial crude oil stocks in the United States are recovering from a January low of around 420 million barrels. The Department of Energy issued the U.S. Petroleum Balance Sheet for the week ending March 1. It shows stocks now at 448.5 million barrels. This remains below recent years but is well above the average of the past five years.

The position of the United States has been enhanced by its provision of crude oil to global markets. The nation exported 4.6 million barrels daily during the report week. Comparable data for the same period last year showed exports of crude oil of 3.4 million barrels per day and 2.4 million daily barrels two years ago.

The International Energy Agency (EIA) believes global markets will be well supplied with crude oil this year. It projects slowing demand growth and higher American supply. This is important because OPEC+ has agreed to extend its voluntary 2.2 million barrels daily cut into the second quarter. Saudi Arabia’s hold on leadership in the oil world may be intact, but its claim to continued dominance is being tested.

Supply/Demand Balances

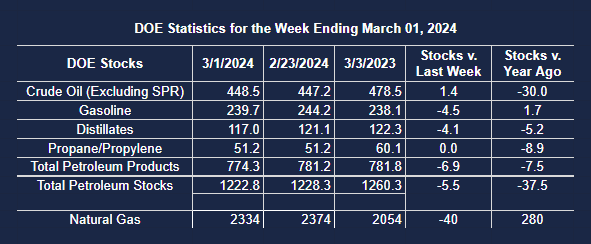

Supply/demand data in the United States for the week ending March 1, 2024 were released by the Energy Information Administration.

Total commercial stocks of petroleum fell (⬇) 5.5 million barrels to 1.2228 billion barrels during the week ending March 1, 2024.

Commercial crude oil supplies in the United States were higher (⬆) by 1.4 million barrels from the previous report week to 448.5 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Up (⬆) 0.8 million barrels 8.3 million barrels

PADD 2: Up (⬆) 2.0 million barrels to 118.2 million barrels

PADD 3: Down (⬇) 2.1 million barrels to 248.3 million barrels

PADD 4: Up (⬆) 0.4 million barrels to 25.2 million barrels

PADD 5: Up (⬆) 0.3 million barrels to 48.5 million barrels

Cushing, Oklahoma inventories were up (⬆) 0.7 million barrels at 31.7 million barrels.

Domestic crude oil production was down (⬇) 100,000 barrels at 13.2 million barrels daily.

Crude oil imports averaged 7.222 million barrels per day, a daily increase (⬆) of 837,000 barrels. Exports decreased (⬇) 91,000 barrels daily to 4.637 million barrels per day.

Refineries used 84.9 percent of capacity; 3.4 percentage points higher (⬆) than the previous report week.

Crude oil inputs to refineries increased (⬆) 594,000 barrels daily; there were 15.268 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, increased (⬆) 618,000 barrels daily to 15.575 million barrels daily.

Total petroleum product inventories decreased (⬇) by 7.4 million barrels from the previous report week, down to 774.3 million barrels.

Total product demand increased (⬆) 765,000 barrels daily to 20.294 million barrels per day.

Gasoline stocks decreased (⬇) 4.5 million barrels from the previous report week; total stocks are 239.7 million barrels.

Demand for gasoline increased (⬆) 547,000 barrels per day to 9.013 million barrels per day.

Distillate fuel oil stocks decreased (⬇) 4.1 million barrels from the previous report week; distillate stocks are at 117.0 million barrels. EIA reported national distillate demand at 4.074 million barrels per day during the report week, an increase (⬆) of 538,000 barrels daily.

Propane stocks were unchanged (=) from the previous report week at 51.2 million barrels. The report estimated current demand at 839,000 barrels per day, a decrease (⬇) of 598,000 barrels daily from the previous report week.

Natural Gas

It is hard to construct a significant bullish case for natural gas prices over the next several weeks. On the contrary, with almost nothing to support a price rally, the recent low of $1.60 reached on February 20 seems an almost inevitable objective for spot natural gas futures prices.

There is one important caveat to remember. Natural gas is no longer a largely domestic commodity, protected from global events by its American focus. U.S. natural gas now dominates global markets too, particularly in Europe. This shift in perspective could change the direction of prices rapidly. A change in geopolitics on the ground or even a major policy shift by a foreign competitor nation could alter the situation.

Just now, however, the fact of a winter without significant HDD development has backed up inventory in the United States. This has spilled over into Europe. Countries of the EU-27 and the UK are ending winter with record-high storage. European governments have also implemented coordinated conservation measures to reduce consumption. These include mandatory demand restrictions.

Storage in the United States is 31 percent greater than the average of the past five years, at 2.3 Tcf for this time of year. The end of the traditional U.S. withdrawal season is hard upon us. EIA estimates we will end the month of March with 2.184 Tcf available. This is 551 Bcf more than the average of the past five years.

The Henry Hub futures contract began trading in April 1990. It has become the focus of natural gas pricing in the United States. Spot futures opened at $1.62 per MMBtu then. They soon fell to $1.06 in June of 1991, the lowest spot futures prices recorded since then. Other significant lows were recorded at $1.25 in January 1995 and $1.517 in June 2020.

Powerhouse is not suggesting that these levels are in the cards. It may be useful to recall them should events turn even more bearish.

According to the EIA:

- Net withdrawals from storage totaled 40 Bcf for the week ending March 1, compared with the five-year (2019–2023) average net withdrawals of 93 Bcf and last year’s net withdrawals of 72 Bcf during the same week. Working natural gas stocks totaled 2,334 Bcf, which is 551 Bcf (31%) more than the five-year average and 280 Bcf (14%) more than last year at this time.

- According to The Desk survey of natural gas analysts, estimates of the weekly net change to working natural gas stocks ranged from net withdrawals of 30 Bcf to 68 Bcf, with a median estimate of 38 Bcf.

- The average rate of withdrawals from storage is 20% lower than the five-year average so far in the withdrawal season (November through March). If the rate of withdrawals from storage matched the five-year average of 5.0 Bcf/d for the remainder of the withdrawal season, the total inventory would be 2,184 Bcf on March 31, which is 551 Bcf higher than the five-year average of 1,633 Bcf for that time of year.