- Houthis threaten Red Sea shipping

- Panama Canal transit affected by El Nino drought

- Weather models open the potential for colder weather in the Eastern United States

The Matrix

Ocean shipping carries the vast majority of global crude oil movement. This is generally not a problem for supply availability, but this year begins with several locations that are not usually at risk.

Oil markets recognize several “shipping chokepoints” that can materially interfere with the reliable flow of crude oil from production sites to refinery centers near consuming areas. Chokepoints develop at narrow routes, offering passage between regions. Two critical chokepoints are currently in the news for differing reasons.

Approximately 5 million barrels per day of oil pass through the Gulf of Aden and the chokepoint of Bab el-Mandeb into the Red Sea and eventually through the Suez Canal. Houthi rebels based in Yemen have attacked container ships in the Gulf of Aden. This has led to the establishment of a multinational “Combined Maritime Force” to keep the shipping lanes open in the region.

Another critical choke point is at the Panama Canal. The Canal is a critical shortcut between the U.S. Gulf Coast energy complex and key importing nations. The Canal cuts the time for transit from Houston to Chile by 9 days versus sailing all the way around South America.

But El Nino gave us more heat than normal last year. This led to drought near the Panama Canal, reducing water levels in the locks. The government cut the allowed number of vessels to transit and will lower the number even more. Transits will fall from 29 to 25 ships immediately and will be cut to 18 ships daily in February.

The Canal will be at less than half of full capacity. Normally, 34-36 ships are accommodated daily. Ironically, the Canal was being used as an alternative to Suez Canal transit.

Recognized Ocean Chokepoints Impacting Oil Movement

The additional shipping time will likely mean less U.S. refined products heading to the west coast of South America. Diesel cargoes may be re-routed to European markets.

Supply/Demand Balances

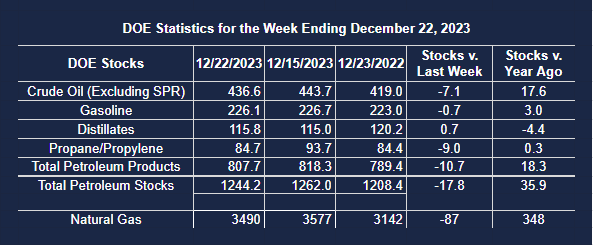

Supply/demand data in the United States for the week ending December 22, 2023 were released by the Energy Information Administration.

Total commercial stocks of petroleum fell (⬇) 17.3 million barrels to 1.2442 billion barrels during the week ending December 22, 2023.

Commercial crude oil supplies in the United States were lower (⬇) by 6.9 million barrels from the previous report week to 436.6 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Up (⬆) 0.3 million barrels to 8.1 million barrels

PADD 2: Up (⬆) 3.9 million barrels to 116.6 million barrels

PADD 3: Down (⬇) 11.0 million barrels to 237.7 million barrels

PADD 4: Up (⬆) 0.6 million barrels to 25.7 million barrels

PADD 5: Down (⬇) 1.0 million barrels to 48.5 million barrels

Cushing, Oklahoma inventories were up (⬆) 1.5 million barrels from the previous report week to 34.0 million barrels.

Domestic crude oil production was unchanged (=) at 13.3 million barrels daily.

Crude oil imports averaged 6.276 million barrels per day, a daily decrease (⬇) of 415,000 barrels. Exports decreased (⬇) 206,000 barrels daily to 3.915 million barrels per day.

Refineries used 93.3 percent of capacity; 0.9 percentage points higher (⬆) than the previous report week.

Crude oil inputs to refineries increased (⬆) 58,000 barrels daily; there were 16.558 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, increased (⬆) 168,000 barrels daily to 17.051 million barrels daily.

Total petroleum product inventories decreased (⬇) by 10.7 million barrels from the previous report week, down to 807.6 million barrels.

Total product demand increased (⬆) 622,000 barrels daily to 21.415 million barrels per day.

Gasoline stocks decreased (⬇) 0.6 million barrels from the previous report week; total stocks are 226.1 million barrels.

Demand for gasoline increased (⬆) 439,000 barrels per day to 9.168 million barrels per day.

Distillate fuel oil stocks increased (⬆) 0.8 million barrels from the previous report week; distillate stocks are at 115.8 million barrels. EIA reported national distillate demand at 3.977 million barrels per day during the report week, an increase (⬆) of 142,000 barrels daily.

Propane stocks decreased (⬇) by 3.7 million barrels from the previous report week to 94.7 million barrels. The report estimated current demand at 1.397 million barrels per day, an increase (⬆) of 166,000 barrels daily from the previous report week.

Natural Gas

This year has seen a parade of below-normal Heating Degree Day readings. The Climate Prediction Center of NOAA put the national shortfall at 196 HDDs since July 1. Regionally, the failure to generate HDDs has been as great as 416 HDDs in the West North Central states, with lower HDD generation in the upper 200s in New England and the Mountain states.

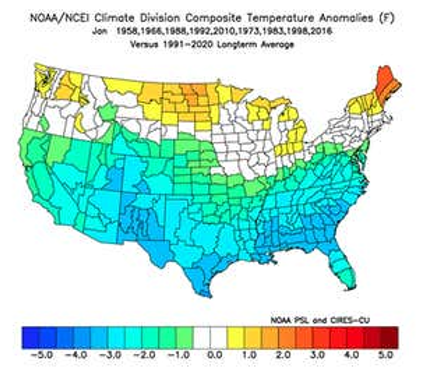

The turn of the year may bring colder weather to the eastern U. S. This could reflect changes in the polar vortex. The polar vortex is one of several climate phenomena that affect weather to one degree or another.

The vortex is a “spinning cone of low pressure,” common in winter. Typically, it lives in the stratosphere, above where most weather develops. It can, however, deform. And if it does so, and the vortex weakens, losing its shape, the likelihood of a colder pattern later in January or February grows. This is what computer models now offer as a possibility.

We are also dealing with a strong El Nino event this year. As discussed by Powerhouse several times, it offers a colder and wetter pattern through March in the South and parts of the Mid-Atlantic.

Temperature departures from average (in degrees F) in January, February, and March during nine previous strong El Niños from 1958 through 2016. (NOAA PSL, CIRES-CU)