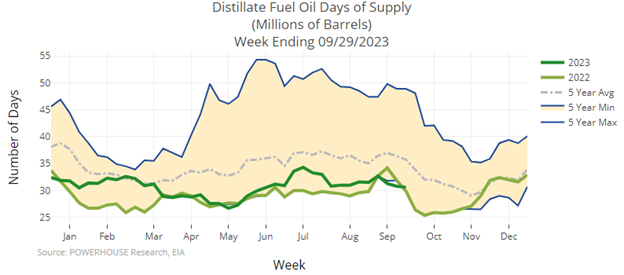

- Distillate fuel supply remains very tight

- Developing heating season could keep situation tight

- Impact of El Nino less clear than earlier thought

- Natural gas prices now facing weakness

The Matrix

There are fewer than thirty days of distillate fuel oil available in the United States in the middle of October. This is the lowest supply level over the past five years for comparable weeks. It comes at a time when distillate fuel oil supplies typically start to fall, reflecting the beginning of winter heating demand and draws on inventory.

Demand for distillate fuel oil has slipped this year. The nation has used 3.8 million barrels per day of distillates through September 29. This was 3.6 percent less than last year. The slower pace of use can be ascribed, at least in part, to fewer Heating Degree Days (HDDs) generated this year.

The nation has generated 58 HDDs less than normal so far this year. Every U.S. Census Region has generated fewer HDDs than normal.1 Fewer HDDs should ease the call on distillate inventories.

Weather forecasters are making much of the El Nino in place. As quoted in prior Weekly Energy Market Situations, “A strengthening El Niño could help make for a winter that is wet and stormy for California and Florida, mild and dry from the Northwest to the Great Lakes, and snowy at times across the Mid-Atlantic and Northeast.”

Recent climate research has suggested a more intense El Nino forecast may be in order. This research found, for example, increasing heavy precipitation in California. In any case, meteorologists think that this El Nino may be nearly as intense as the super El Nino of 2015-2016. That time, weather produced record cyclones in the Pacific, and an historic snowstorm along the Mid Atlantic coast.

Last week, prices for ULSD spot futures closed on a strong note. Settlement was at $3.21, fully seventeen cents higher than the week before. Prices are roughly in the middle of a range between $2.83 and $3.42. Failure to generate HDDs is bearish, but the situation in Gaza is unresolved. This could become very bullish should the conflict widen. Those with upside price exposure should consider call options.

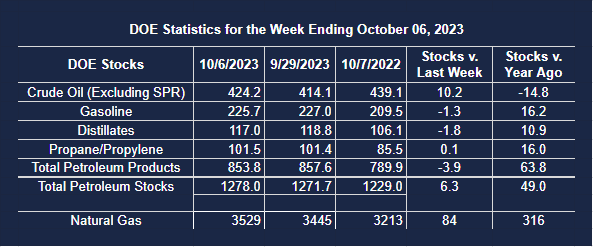

Supply/Demand Balances

Supply/demand data in the United States for the week ending October 6, 2023 were released by the Energy Information Administration.

Total commercial stocks of petroleum rose (⬆) 6.3 million barrels to 1.2780 billion barrels during the week ending October 6, 2023.

Commercial crude oil supplies in the United States were higher (⬆) by 10.2 million barrels from the previous report week to 424.2 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Down (⬇) 0.4 million barrels to 6.8 million barrels

PADD 2: Up (⬆) 0.5 million barrels to 102.4 million barrels

PADD 3: Up (⬆) 9.3 million barrels to 245.7 million barrels

PADD 4: Unchanged (=) at 23.5 million barrels

PADD 5: Up (⬆) 0.6 million barrels to 45.7 million barrels

Cushing, Oklahoma inventories were down (⬇) 0.3 million barrels from the previous report week to 21.8 million barrels.

Domestic crude oil production was up (⬆) 300,000 barrels at 13.2 million barrels daily.

Crude oil imports averaged 6.329 million barrels per day, a daily increase (⬆) of 115,000 barrels. Exports decreased (⬇) 1.889 million barrels daily to 3.067 million barrels per day.

Refineries used 85.7 percent of capacity; 1.6 percentage points lower (⬇) than the previous report week.

Crude oil inputs to refineries decreased (⬇) 399,000 barrels daily; there were 15.203 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, decreased (⬇) 291,000 barrels daily to 15.662 million barrels daily.

Total petroleum product inventories decreased (⬇) by 3.8 million barrels from the previous report week, up to 853.8 million barrels.

Total product demand increased (⬆) 509,000 barrels daily to 19.666 million barrels per day.

Gasoline stocks decreased (⬇) 1.3 million barrels from the previous report week; total stocks are 225.7 million barrels.

Demand for gasoline increased (⬆) 567,000 barrels per day to 8.581 million barrels per day.

Distillate fuel oil stocks decreased (⬇) 1.8 million barrels from the previous report week; distillate stocks are at 117.0 million barrels. EIA reported national distillate demand at 3.670 million barrels per day during the report week, a decrease (⬇) of 144,000 barrels daily.

Propane stocks increased (⬆) by 0.1 million barrels from the previous report week to 101.5 million barrels. The report estimated current demand at 587,000 barrels per day, a decrease (⬇) of 137,000 barrels daily from the previous report week.

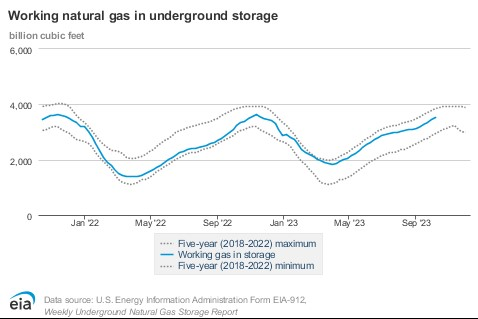

Natural Gas

Natural gas prices are being impacted by global geopolitical events. Last week’s hostilities in Gaza were reflected in an eight-month high in European natural gas prices. This was driven in part by a shutdown of production in Israel for reasons of safety. Egypt is reportedly re-examining its own LNG export plans.

The situation was not repeated in the United States, where prices fell to a weekly low. Front-month natural gas futures closed at $3.326, giving up more than ten cents in price. Weather extremes are abating as October advances. Heating Degree Days trailed normal for the week ending October 5 by 26 HDDs. Cooling Degree Days were 10 above normal. Both heating and cooling demand were reduced.

Natural gas storage in the United States is expected to be 3,758 Bcf on October 31, which is 163 Bcf higher than the five-year average of 3,595 Bcf for that time of year. In Europe, storage is put at 97 percent full.

Price support can be found around $2.50 per MMBtu and more importantly, at $1.946.

According to the EIA:

- Net injections into storage totaled 84 Bcf for the week ending October 6, compared with the five-year (2018–2022) average net injections of 93 Bcf and last year’s net injections of 125 Bcf during the same week. Working natural gas stocks totaled 3,529 Bcf, which is 163 Bcf (5%) more than the five-year average and 316 Bcf (10%) more than last year at this time.

- According to The Desk survey of natural gas analysts, estimates of the weekly net change to working natural gas stocks ranged from net injections of 77 Bcf to 105 Bcf, with a median estimate of 89 Bcf.

- The average rate of injections into storage is 7% lower than the five-year average so far in the refill season (April through October). If the rate of injections into storage matched the five-year average of 9.1 Bcf/d for the remainder of the refill season, the total inventory would be 3,758 Bcf on October 31, which is 163 Bcf higher than the five-year average of 3,595 Bcf for that time of year.

1 Degree day is a quantitative index demonstrated to reflect demand for energy to heat or cool houses and businesses. The National Weather Service says, “This index is derived from daily temperature observations at nearly 200 major weather stations in the contiguous United States.