- Oil industry better positioned to withstand attack on Israel

- Oil prices now set at open-outcry NYMEX Exchange

- Alternative oil supplies available, with provisos

- El Nino points to snowy, warmer winter.

The Matrix

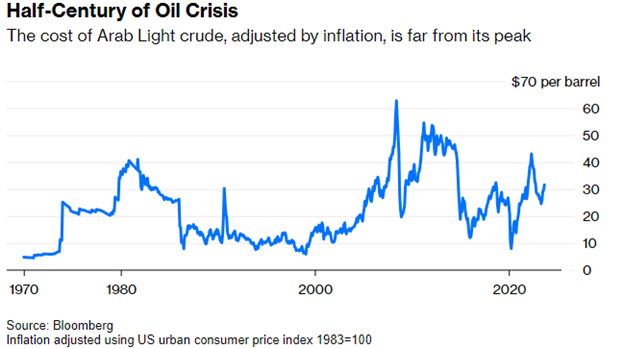

The attack on Israel this weekend by Hamas was redolent of a similar initiative fifty years ago, when the Yom Kippur War burst on global oil markets. Similar, but not the same.

This writer was walking towards a morning Yom Kippur service in New Brunswick, NJ, in October, 1973 when news came of a coordinated move against Israel by several Arab countries. Egypt, Saudi Arabia, Syria, and Jordan joined to destroy Israel in a violent anti-Semitic attack.

Little prayer or contemplation attended our service that day. Fear, despair and resignation were more the tenor with concern that overt bigotry could soon return even here in America.

This Weekly Energy Market Situation is not a political commentary; we will leave it to others to expand on socioeconomic developments of the past half-century.

We can say, however, that this most recent Middle East event demonstrates how different global oil affairs have become. The effect of this latest Middle East attack is not likely to have the same reactions as fell out from the events of October 6, 1973.

WTI crude oil futures popped on the news of the attack, gaining $4.43/bbl at their highpoint on Monday. Since then, crude oil futures have pulled back by approximately $1.25/bbl. Diesel futures tell a slightly different tale. ULSD futures prices spiked on Sunday evening as traders reacted, jumping nearly 12 cents per gallon. However, after a brief swoon on Monday morning, prices have moved above the levels registered right after the news of the attack broke.

This is, in fact, one important change since 1973. Prices then were set by large international oil companies to meet various market and political objectives. Today, NYMEX allows for prices to be set openly by market forces.

Hamas, the terrorist organization that launched the attacks, is generally regarded as an agent of Iran. Iran has been engaged in a rapprochement with the United States, providing around 700,000 barrels daily to global supply. If Iran is seen as providing the impetus for this latest attack, all bets are off. Israel could react unilaterally, removing that supply from the market continuing the push to $100+ crude oil.

Fallout from the attack could also impede any Saudi-Israeli deal. As noted recently in WEMS, such a diplomatic breakthrough could have been bearish for prices as Saudi Arabia could have responded with more oil to global markets.

Supply/Demand Balances

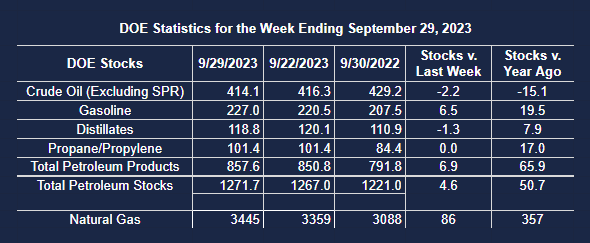

Supply/demand data in the United States for the week ending September 29, 2023 were released by the Energy Information Administration.

Total commercial stocks of petroleum rose (⬆) 4.6 million barrels to 1.2717 billion barrels during the week ending September 29, 2023.

Commercial crude oil supplies in the United States were lower (⬇) by 2.2 million barrels from the previous report week to 414.1 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Up (⬆) 0.4 million barrels to 7.2 million barrels

PADD 2: Down (⬇) 1.0 million barrels to 101.9 million barrels

PADD 3: Down (⬇) 1.6 million barrels to 236.4 million barrels

PADD 4: Unchanged (=) at 23.5 million barrels

PADD 5: Unchanged (=) at 45.1 million barrels

Cushing, Oklahoma inventories were up (⬆) 0.1 million barrels from the previous report week to 22.1 million barrels.

Domestic crude oil production was unchanged (=) at 12.9 million barrels daily.

Crude oil imports averaged 6.215 million barrels per day, a daily decrease (⬇) of 1.014 million barrels. Exports increased (⬆) 944,000 barrels daily to 4.956 million barrels per day.

Refineries used 87.3 percent of capacity; 2.2 percentage points lower (⬇) than the previous report week.

Crude oil inputs to refineries decreased (⬇) 463,000 barrels daily; there were 15.602 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, decreased (⬇) 400,000 barrels daily to 15.953 million barrels daily.

Total petroleum product inventories increased (⬆) by 6.9 million barrels from the previous report week, up to 857.6 million barrels.

Total product demand decreased (⬇) 984,000 barrels daily to 19.157 million barrels per day.

Gasoline stocks increased (⬆) 6.5 million barrels from the previous report week; total stocks are 227.0 million barrels.

Demand for gasoline decreased (⬇) 606,000 barrels per day to 8.014 million barrels per day.

Distillate fuel oil stocks decreased (⬇) 1.3 million barrels from the previous report week; distillate stocks are at 118.8 million barrels. EIA reported national distillate demand at 3.815 million barrels per day during the report week, a decrease (⬇) of 157,000 barrels daily.

Propane stocks were unchanged (=) at 101.4 million barrels. The report estimated current demand at 724,000 barrels per day, an increase (⬆) of 180,000 barrels daily from the previous report week.

Natural Gas

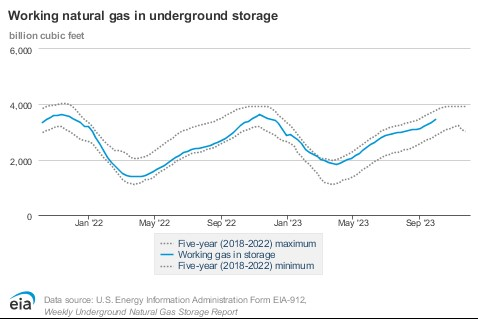

Injections of natural gas into underground storage were 86 Bcf for the week ending October 4. This was well below industry expectations of 94 Bcf. This vaulted prices higher, and at writing, challenging $3.30. Prices are at resistance but the advance has not been on high volume. Major resistance above at $4.75 remains light years away.

Weather uncertainties abound. El Nino is in force, suggesting snow in the Northeast and Mid-Atlantic states, a mild and dry pattern from the Northwest to the Great Lakes, and wet, stormy conditions in California and Florida. Forecasters suggest warmer-than-normal weather is more likely than usual in the Northeast.

According to the EIA:

- Net injections into storage totaled 86 Bcf for the week ending September 29, compared with the five-year (2018–2022) average net injections of 103 Bcf and last year’s net injections of 126 Bcf during the same week. Working natural gas stocks totaled 3,445 Bcf, which is 172 Bcf (5%) more than the five-year average and 357 Bcf (12%) more than last year at this time.

- According to The Desk survey of natural gas analysts, estimates of the weekly net change to working natural gas stocks ranged from net injections of 87 Bcf to 98 Bcf, with a median estimate of 94 Bcf.

- The average rate of injections into storage is 7% lower than the five-year average so far in the refill season (April through October). If the rate of injections into storage matched the five-year average of 10.0 Bcf/d for the remainder of the refill season, the total inventory would be 3,767 Bcf on October 31, which is 172 Bcf higher than the five-year average of 3,595 Bcf for that time of year.