- Higher oil prices despite economic uncertainty

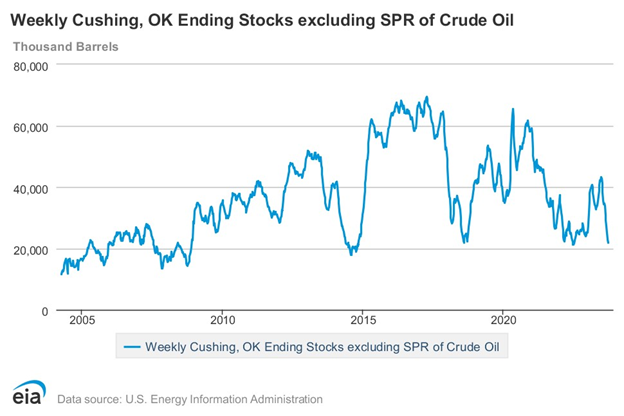

- Tight supply evident at Cushing OK pricing point

- Demand for propane fell noticeably

- Natural gas prices struggle to break above $3.00.

The Matrix

New highs were seen in WTI futures last week. Prices soared to $95.03 and settled at $90.79. The week’s activity formed a doji pattern, emphasizing the uncertainties the economy and energy markets are facing.

In the near term, global crude oil is tight. Expectations that prices will reach $100 remain in place, but some question if three-digit prices are sustainable for a longer time.

Because WTI crude oil futures are priced at Cushing, the impact of supply levels there is especially important in evaluating price action. Crude oil prices have become heavily backwardated. Backwardation in prices expresses a bullish view of market participants, reflecting the ability of Saudi Arabia and other OPEC+ producers to withhold supply. But demand has not faltered significantly. In this context, the market may not be seeing a long-term price adjustment, but rather a short squeeze that would eventually be satisfied with prices returning to prior levels.

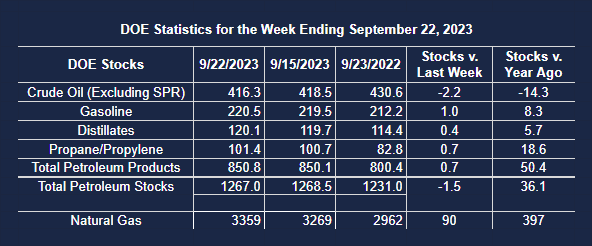

The U.S. Petroleum Balance Sheet for the week ending September 22, continued the shortfall narrative. U.S. crude oil lost 2.2 million barrels, moving to 416.3 million barrels. Small gains in gasoline (+1.0 million barrels) and distillate fuel oil (+0.4 million barrels) were not enough to reverse the continued erosion of American oil supply which netted a loss of 1.5 million barrels for the week.

Demand fell by 773,000 barrels daily for the week, but still took more than twenty million barrels per day from supply. Loss in demand was especially high for propane/propylene which came in at 544,000 barrels per day, less than half of the previous week’s use.

Motor gasoline usually experiences fading demand as summer ends. Demand was 8.6 million barrels daily for the Report week, a weekly gain of 210,000 barrels per day. Cumulatively, demand year to date has registered 8.9 million barrels daily, 1.6 percent higher than last year for the same period.

Supply/Demand Balances

Supply/demand data in the United States for the week ending September 22, 2023 were released by the Energy Information Administration.

Total commercial stocks of petroleum fell (⬇) 1.5 million barrels to 1.2670 billion barrels during the week ending September 22, 2023.

Commercial crude oil supplies in the United States were lower (⬇) by 2.2 million barrels from the previous report week to 416.3 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Down (⬇) 0.6 million barrels to 6.8 million barrels

PADD 2: Up (⬆) 1.4 million barrels to 102.9 million barrels

PADD 3: Down (⬇) 1.1 million barrels to 238.0 million barrels

PADD 4: Down (⬇) 0.4 million barrels to 23.5 million barrels

PADD 5: Down (⬇) 1.5 million barrels to 45.1 million barrels

Cushing, Oklahoma inventories were down (⬇) 0.9 million barrels from the previous report week to 22.0 million barrels.

Domestic crude oil production was unchanged (=) at 12.9 million barrels daily.

Crude oil imports averaged 7.229 million barrels per day, a daily increase (⬆) of 711,000 barrels. Exports decreased (⬇) 1.055 million barrels daily to 4.012 million barrels per day.

Refineries used 89.5 percent of capacity; 2.4 percentage points lower (⬇) than the previous report week.

Crude oil inputs to refineries decreased (⬇) 239,000 barrels daily; there were 16.065 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, decreased (⬇) 439,000 barrels daily to 16.353 million barrels daily.

Total petroleum product inventories increased (⬆) by 0.7 million barrels from the previous report week, up to 850.7 million barrels.

Total product demand decreased (⬇) 773,000 barrels daily to 20.141 million barrels per day.

Gasoline stocks increased (⬆) 1.0 million barrels from the previous report week; total stocks are 220.5 million barrels.

Demand for gasoline increased (⬆) 210,000 barrels per day to 8.619 million barrels per day.

Distillate fuel oil stocks increased (⬆) 0.4 million barrels from the previous report week; distillate stocks are at 120.1 million barrels. EIA reported national distillate demand at 3.972 million barrels per day during the report week, a decrease (⬇) of 194,000 barrels daily.

Propane stocks increased (⬆) by 0.7 million barrels from the previous report week to 101.4 million barrels. The report estimated current demand at 544,000 barrels per day, a decrease (⬇) of 701,000 barrels daily from the previous report week.

Natural Gas

Spot natural gas futures gained a bit as November became the front month contract last week. Prices settled at $2.929 after failing to reach $3.00. Nearby resistance remains at $3.018. Early action this week appears weak, providing no follow through to mid-week gains last week. In fact, there is a gap between $2.781 and $2.855 which adds to downside pressure. It could represent a reasonable entry point for buyers.

Injections to underground storage this year are below the average of the past five year period, however, EIA projects the supply of natural gas at the end of October will be 3.8 Tcf. This should be enough to start this year’s withdrawal period with adequate stocks.

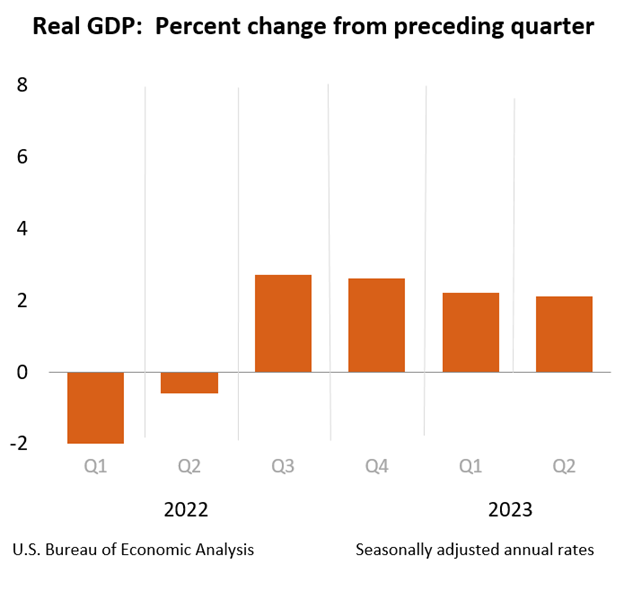

The commodity’s price may also be responding to growing uncertainty over the economy’s direction for the next few quarters. National data on consumer expectations, supply manager planning, and interest rate policy by the Federal Reserve are adding to a bearish economic tone but a tipping point has not been reached.

Gross Domestic Product is growing, but the rate of change is slowing. Data for the third quarter will soon be available. At writing, a shutdown of government has been averted but the ultimate resolution to this problem remains uncertain.

According to the EIA:

- Net injections into storage totaled 90 Bcf for the week ending September 22, compared with the five-year (2018–2022) average net injections of 84 Bcf and last year’s net injections of 103 Bcf during the same week. Working natural gas stocks totaled 3,359 Bcf, which is 189 Bcf (6%) more than the five-year average and 397 Bcf (13%) more than last year at this time.

- The average rate of injections into storage is 7% lower than the five-year average so far in the refill season (April through October). If the rate of injections into storage matched the five-year average of 10.9 Bcf/d for the remainder of the refill season, the total inventory would be 3,784 Bcf on October 31, which is 189 Bcf higher than the five-year average of 3,595 Bcf for that time of year.