- Crude oil rally now extended, may set back

- Technical measurements are turning lower

- 50% price retracement is $79.85

- The highest natural gas close since August 10th did not break resistance.

The Matrix

WTI crude oil topped $90 dollars per barrel for the week ending September 22. This was the highest price recorded this year. It is likely a milestone to be beat as prices move toward three-digit handles. OPEC+ solidarity in suppressing production in service of higher prices remains in force as a successful strategy.

Voluntary concession of market share is not typical in global crude oil supply. It may work in the near term. But as alternative supply sources are granted room in the market, OPEC+ may open a path to competition down the road it may regret.

The chart of weekly WTI spot crude oil futures prices, shown above, shows the close over $90/bbl last week. It also shows the Relative Strength Index (RSI), a statistical analysis commonly used by market technicians to gauge the strength of the move. The RSI compares the strength of the market on up days versus down days to determine price momentum.

The RSI does not currently support the idea of the current rally sustaining – at least in the short term. The current rally started late in June, with price around $67.25. The move to $90 has taken only about ten weeks. Little surprise that technical analysis shows some exhaustion setting in. RSI reached “overbought” levels and has started to retreat.

None of this is to suggest that crude oil prices will not reach $100+, but rather that a setback may soon develop. This could provide a better entry level for bulls now standing aside. And that better level might come with a price retracement to standard Fibonacci levels. For reference, a retracement of 50% of the recent ten-week move is at $79.85.

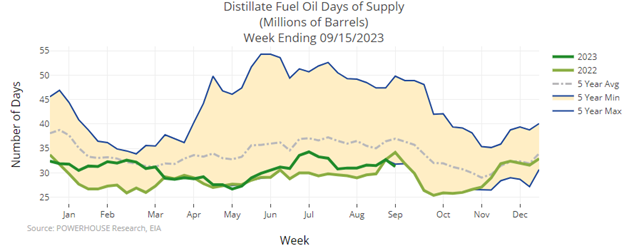

Price gains for petroleum products did not match gains for crude oil. With facilities already operating near capacity, the impact of higher prices on product availability may not be substantial. We still have tight product inventories.

Supply/Demand Balances

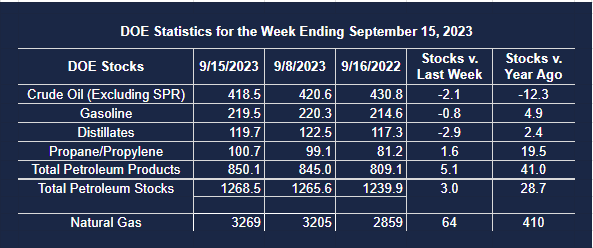

Supply/demand data in the United States for the week ending September 15, 2023 were released by the Energy Information Administration.

Total commercial stocks of petroleum rose (⬆) 3.0 million barrels to 1.2685 billion barrels during the week ending September 15, 2023.

Commercial crude oil supplies in the United States were lower (⬇) by 2.1 million barrels from the previous report week to 418.5 million barrels.

Crude oil inventory changes by PAD District:

PADD 1: Up (⬆) 0.2 million barrels to 7.4 million barrels

PADD 2: Down (⬇) 3.2 million barrels to 101.5 million barrels

PADD 3: Up (⬆) 0.4 million barrels to 239.1 million barrels

PADD 4: Down (⬇) 0.1 million barrels to 23.9 million barrels

PADD 5: Up (⬆) 0.5 million barrels to 46.6 million barrels

Cushing, Oklahoma inventories were down (⬇) 2.1 million barrels from the previous report week to 22.9 million barrels.

Domestic crude oil production was unchanged (=) at 12.9 million barrels daily.

Crude oil imports averaged 6.517 million barrels per day, a daily decrease (⬇) of 1.065 barrels. Exports increased (⬆) 1.977 million barrels daily to 5.067 million barrels per day.

Refineries used 91.9 percent of capacity; 1.8 percentage points lower (⬇) than the previous report week.

Crude oil inputs to refineries decreased (⬇) 496,000 barrels daily; there were 16.304 million barrels per day of crude oil run to facilities. Gross inputs, which include blending stocks, decreased (⬇) 332,000 barrels daily to 16.792 million barrels daily.

Total petroleum product inventories increased (⬆) by 5.0 million barrels from the previous report week, up to 850.0 million barrels.

Total product demand decreased (⬇) 76,000 barrels daily to 20.914 million barrels per day.

Gasoline stocks decreased (⬇) 0.8 million barrels from the previous report week; total stocks are 219.5 million barrels.

Demand for gasoline increased (⬆) 103,000 barrels per day to 8.410 million barrels per day.

Distillate fuel oil stocks decreased (⬇) 2.9 million barrels from the previous report week; distillate stocks are at 119.7 million barrels. EIA reported national distillate demand at 4.166 million barrels per day during the report week, an increase (⬆) of 588,000 barrels daily.

Propane stocks increased (⬆) by 1.6 million barrels from the previous report week to 100.7 million barrels. The report estimated current demand at 1.245 million barrels per day, an increase (⬆) of 743,000 barrels daily from the previous report week.

Natural Gas

A modest rally brought spot natural gas futures to $2.888 per MMcf/d for the week ending September 22nd. This was the highest close since August 10th, but it did not break resistance at $3.02. Press reports attributed the gain to “carryover support” from a European rally. Until prices breach resistance, the seasonally-expected autumn rally has not started.

Until prices reach new resistance, the market cannot be considered to be in a fall rally.

Price determining factors continue to favor flat futures markets. And bearish elements are appearing too. LNG workers in Australia have ended a strike. Australia is an important LNG supplier to Asia, standing third among global exporters. It provides about one-tenth of global LNG supplies.

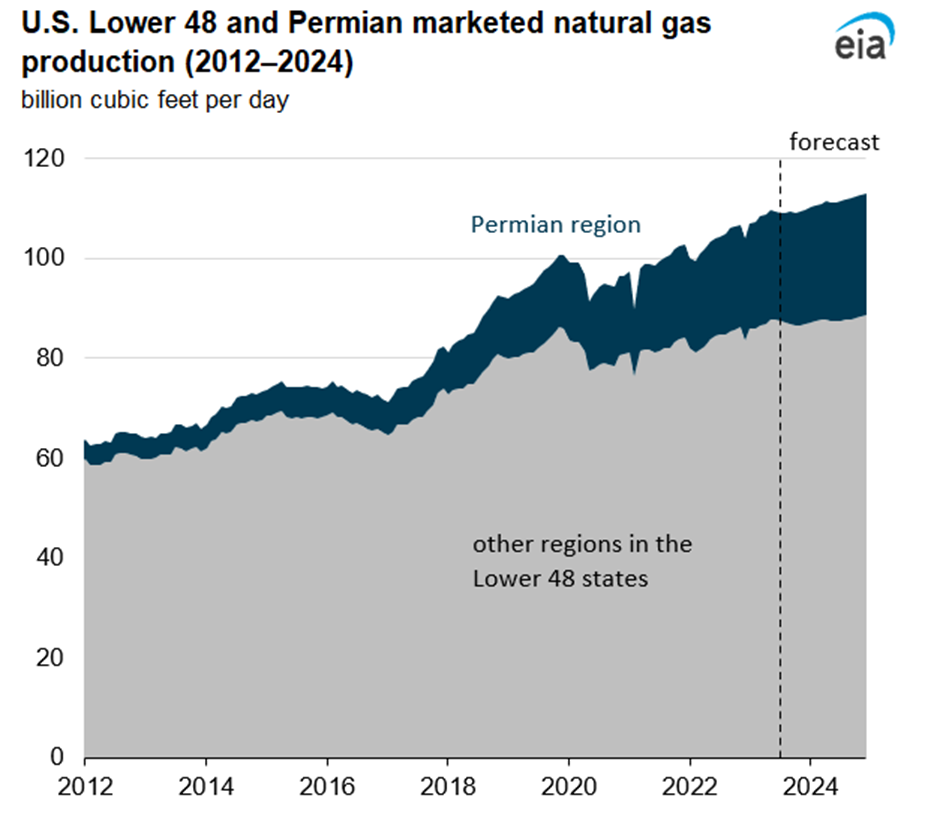

Higher well productivity for wells in the Permian Basin is contributing to rapid growth in Lower 48 states U.S. marketed natural gas production. The Natural Gas Weekly Update for September 21 projects a five percent growth (5.2 Bcf/d) in 2023 and an additional two percent (2.6 Bcf/d) in 2024. This is bearish for price.

Permian production is expected to grow 12 percent this year (2.3 Bcf/d) and an added eight percent next year.

The importance of improved technology in providing domestic supply and national security has been key to production growth. Specifically, the industry has developed improved hydraulic and horizontal drilling techniques. Lateral drilling has lengthened from less than 4,000 feet in 2010 to over 10,000 feet in 2022.

Natural gas production in the Permian is associated with crude oil production. And with OPEC producers limiting their supply to support prices, even more production of Permian supplies is likely.

According to the EIA:

- Net injections into storage totaled 64 Bcf for the week ending September 15, compared with the five-year (2018–2022) average net injections of 84 Bcf and last year’s net injections of 99 Bcf during the same week. Working natural gas stocks totaled 3,269 Bcf, which is 183 Bcf (6%) more than the five-year average and 410 Bcf (14%) more than last year at this time.

- According to The Desk survey of natural gas analysts, estimates of the weekly net change to working natural gas stocks ranged from net injections of 55 Bcf to 77 Bcf, with a median estimate of 65 Bcf.

- The average rate of injections into storage is 7% lower than the five-year average so far in the refill season (April through October). If the rate of injections into storage matched the five-year average of 11.1 Bcf/d for the remainder of the refill season, the total inventory would be 3,778 Bcf on October 31, which is 183 Bcf higher than the five-year average of 3,595 Bcf for that time of year.